8 Easy Facts About Stonewell Bookkeeping Shown

Wiki Article

Not known Incorrect Statements About Stonewell Bookkeeping

Table of ContentsStonewell Bookkeeping Things To Know Before You BuyExcitement About Stonewell BookkeepingStonewell Bookkeeping - Truths3 Simple Techniques For Stonewell BookkeepingThe Greatest Guide To Stonewell Bookkeeping

Rather than going with a declaring cabinet of various papers, billings, and receipts, you can present comprehensive documents to your accountant. Consequently, you and your accounting professional can save time. As an included benefit, you may even be able to determine potential tax write-offs. After using your audit to file your tax obligations, the IRS may select to execute an audit.

That financing can come in the kind of proprietor's equity, gives, organization fundings, and financiers. Financiers require to have a great idea of your company before investing.

Not known Facts About Stonewell Bookkeeping

This is not planned as lawful advice; to learn more, please visit this site..

We addressed, "well, in order to know exactly how much you require to be paying, we require to recognize just how much you're making. What is your net revenue? "Well, I have $179,000 in my account, so I guess my net revenue (revenues much less expenditures) is $18K".

Some Known Factual Statements About Stonewell Bookkeeping

While it can be that they have $18K in the account (and even that may not hold true), your equilibrium in the bank does not necessarily establish your revenue. If someone received a grant or a funding, those funds are ruled out earnings. And they would not function right into your income statement in determining your revenues.

While it can be that they have $18K in the account (and even that may not hold true), your equilibrium in the bank does not necessarily establish your revenue. If someone received a grant or a funding, those funds are ruled out earnings. And they would not function right into your income statement in determining your revenues.Numerous things that you assume are expenditures and deductions are in truth neither. Accounting is the process of recording, identifying, and organizing a business's monetary deals and tax obligation filings.

An effective service needs aid from experts. With sensible objectives and a proficient accountant, you can easily deal with obstacles and maintain those concerns at bay. We commit our energy to guaranteeing you have a solid economic foundation for development.

The 9-Minute Rule for Stonewell Bookkeeping

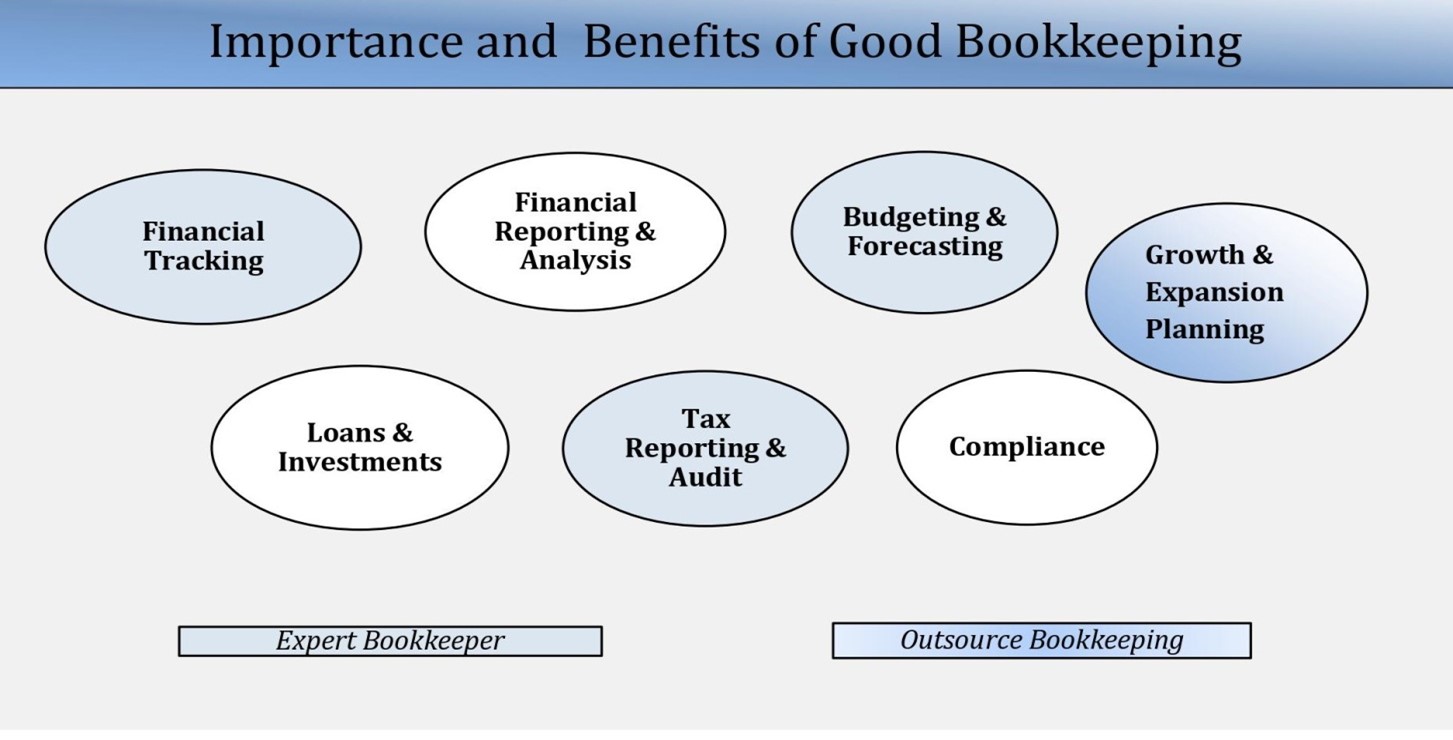

Precise accounting is the foundation of excellent economic administration in any kind of service. It helps track revenue and expenses, ensuring every purchase is recorded correctly. With good bookkeeping, companies can make better choices since clear economic records use valuable data that can guide method and enhance revenues. This details is key for long-lasting preparation and projecting.Accurate financial statements construct trust with loan providers and capitalists, enhancing your possibilities of obtaining the capital you require to expand., businesses ought to consistently reconcile their accounts.

They assure on-time payment of expenses and fast consumer settlement of billings. This improves money flow and aids to prevent late fines. A bookkeeper will certainly go across bank statements with interior records a minimum of when a month to find blunders or variances. Called bank settlement, this process assures that the monetary records of the business suit those of the bank.

They monitor current payroll information, subtract tax obligations, and number pay scales. Bookkeepers generate basic financial records, consisting of: Revenue and Loss Statements Shows income, expenses, and net profit. Annual report Details possessions, obligations, and equity. Capital Statements Tracks cash motion in and out of the business (https://www.lidinterior.com/profile/stonewellbookkeeping7700262003/profile). These reports help entrepreneur comprehend their financial placement and make notified choices.

The Best Strategy To Use For Stonewell Bookkeeping

While this is economical, it can be taxing and vulnerable to mistakes. Devices like copyright, Xero, and FreshBooks allow organization proprietors to automate accounting tasks. These programs aid with invoicing, financial institution settlement, and monetary reporting.

Report this wiki page